By Imam Murtadha Gusau

In the Name of Allah, the Entirely Merciful, the Especially Merciful

Praise is due to Allah, Lord of the worlds, may the blessings and peace be upon our beloved master Muhammad, the last of Prophets, on his family, and all his companions.

Fellow Nigerians! Know that, the Halal economy strategy has in recent years emerged as one of the most dynamic sub-sectors of the global economy with a powerful transformative force for socio-economic development. It has also become a leading component of economic growth, employment, trade, innovation and social cohesion in most advanced and emerging economies.

According to the State of the Global Islamic Economy Report 2022, an annual industry report produced by Thomson Reuters, the burgeoning Halal economy is growing at nearly double the global rate. The report states that the total value of the Global Halal economy in 2021 is USD$4.831 trillion, and it is forecasted to reach USD6.854 trillion by the year 2025.

The global halal market of 1.8 billion Muslims and 0.2 billion non-Muslims is no longer confined to food and food related products. It has since assumed multi-sectoral dimensions covering sectors and products ranging from: Agribusiness, Food and Beverages.

Non-food consumables sector which comprises: fashion, pharmaceuticals, toiletries, healthcare products and cosmetics.

Services sector which comprises: finance and banking, real estate, hotels, travel and tourism, Renewable Energy and Environment.

Spin-off and ancillary activities such as: research and development, logistics and transport, print and electronic media, branding and marketing, packaging and handling, audit, and certification.

In spite of the word ‘halal’ (permissible) being associated with Islam, a halal economy ultimately benefits the entire world. Most of the founding principles of a Halal economy are naturally aligned with the universally recognised values of ethics and sustainability. As a result, halal products and services are attractive to non-Muslim consumers, particularly in the light of current global sentiments where the demand for ethical and socially-conscious product offerings are on the rise. It should be emphasised that the halal market is non-exclusive to Muslims, and has gained increasing acceptance among non-Muslim consumers who associate halal with ethical consumerism. As such, the values promoted by halal – social responsibility, stewardship of the earth, economic and social justice, animal welfare and ethical investment – have gathered interest beyond its religious compliance.

Dear brothers and sisters! The Halal Economy Initiative is Africa’s primary platform for knowledge sharing and collaboration on the Halal Economy. It advances its work through publications, collaboration and networking, virtual and in-personal events. The Initiative works directly with Governments and enterprises in their efforts to attract investment, increase trade and foreign exchange earnings, and gain access to new markets.

It places strategic emphasis on agriculture, manufacturing and industrialisation as the basis for economic structural change in Africa. The development of Halal Special Economic Zones, Export Processing Zones, Agro-industrial Parks, Free Trade Zones and Logistics Hubs is at the heart of the Initiative, and support Rural Transformation Centres, therefore, is central to this strategy.

The Initiative applies innovative and ethical business and financial models, public private partnerships that combine industry with private-public investments to support the development of its Halal economy programs. Furthermore, the Initiative helps to structure and raise financing from a host of international lenders, including Islamic commercial banks, multilateral and bilateral lending institutions, export credit agencies, and ethical capital (Sukuk) markets to develop the projects of its clients or partners.

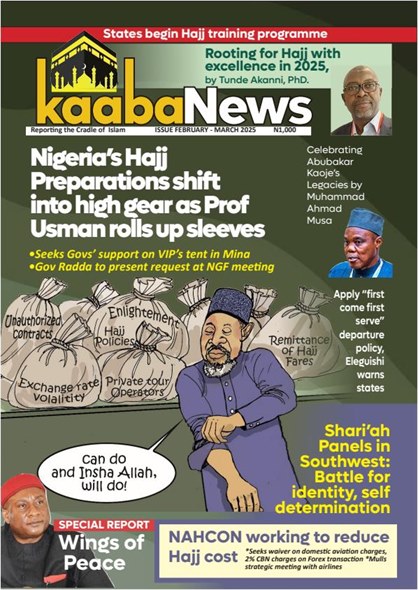

READ e-copy: Kaaba News Magazine OCTOBER 2025 COMPLETE

Respected brothers and sisters! A halal economy is an economic system based on Islamic principles, encompassing various sectors like food, finance, tourism, and fashion that adhere to halal (permissible) standards. It emphasises ethical, transparent practices in line with Shari’ah law. The halal economy is rapidly growing globally, driven by increasing demand for halal products and services among Muslim and non-Muslim consumers.

While food is the most commonly recognised aspect, the halal economy includes finance, tourism, fashion, cosmetics, pharmaceuticals, and entertainment. It’s an ecosystem that ensures ethical practices, transparency, and moral values, offering a holistic approach to commerce that appeals not just to Muslims but to many non-Muslims as well.

The most prominent sector of the halal economy is food and beverages. Halal food is prepared following Islamic dietary laws. It must be free from pork, alcohol, and other prohibited substances. The meat must be slaughtered humanely and with specific prayers. The global halal food market is rapidly expanding, offering opportunities for businesses and consumers who value high-quality, ethically sourced products.

Islamic finance is another cornerstone of the halal economy, distinguished by its adherence to Shari’ah law. Key principles include the prohibition of interest (riba), risk-sharing, and ensuring that financial activities are tied to real assets. Common Islamic finance products include Sukuk (Islamic bonds), Takaful (Islamic insurance), and Murabaha (cost-plus financing). Islamic banking has grown exponentially in recent years, providing an ethical alternative to conventional finance for millions worldwide.

The halal travel industry caters to the specific needs of Muslim travelers, offering services like halal food, prayer facilities, and family-friendly entertainment. Halal tourism is designed to respect Islamic values, allowing Muslims to explore the world comfortably while adhering to their religious beliefs. Countries like Malaysia, Turkey, and Indonesia have developed comprehensive halal travel sectors to attract this market.

Halal cosmetics and pharmaceuticals are rapidly growing sectors of the halal economy. Products in these categories are free from haram (prohibited) ingredients like alcohol and animal derivatives not slaughtered according to Islamic guidelines. Halal certification for beauty and health products is becoming increasingly important to ensure that Muslim consumers can maintain their lifestyles without compromising their beliefs.

Modest fashion, also known as halal fashion, is designed to align with Islamic guidelines for dressing modestly. This sector has gained global attention in recent years, with brands and designers creating stylish yet modest clothing. The rise of modest fashion showcases the demand for apparel that respects cultural and religious values while staying on-trend.

The halal economy is not confined to Muslim-majority countries; it is a global phenomenon. The increasing demand for halal products and services is driven by the growing Muslim population, higher awareness of halal standards, and a desire for ethical and sustainable options.

According to the State of the Global Islamic Economy Report, the global halal economy is projected to exceed trillions of dollars. Muslim consumers are looking for products that align with their values, and non-Muslim consumers are also turning to halal products for their perceived benefits, such as ethical sourcing and high quality.

The halal economy emphasises ethical production, consumption, and financial practices. From humane animal treatment in halal food to profit-sharing models in Islamic finance, transparency and moral responsibility are cornerstones of the halal economic system.

The halal economy creates opportunities for entrepreneurs and businesses worldwide. The demand for halal products has led to increased exports, new job opportunities, and the rise of innovative halal startups. Countries like Malaysia and the United Arab Emirates have become global hubs for halal certification and trade.

Since the halal economy aligns with the moral and social principles of Islam, it supports community welfare, fair trade, and ethical consumerism. Islamic finance, for example, includes the concept of Zakat (charitable giving), ensuring wealth distribution and helping those in need.

While the halal economy offers tremendous growth potential, it is not without challenges. These include:

- Standardisation and Certification: The lack of uniform global halal standards can lead to confusion and hinder market growth. Efforts are being made to develop universal certification processes.

- Consumer Awareness: Educating consumers about halal product’s benefits is crucial for expanding the market beyond Muslim communities.

- Market Accessibility: Expanding into non-Muslim markets requires addressing misconceptions and emphasising the ethical and high-quality aspects of halal products.

However, these challenges also present opportunities: As awareness and demand increase, businesses can innovate to provide better products and services that cater to both Muslim and non-Muslim consumers alike.

Fellow Nigerians! Know that, the halal economy strategy has transcended its traditional boundaries to emerge as a global economic powerhouse, with projections estimating its value at $7.7 trillion by 2025, up from $5.7 trillion in 2021. This growth is not merely a reflection of religious adherence but a broader shift toward ethical, sustainable, and transparent consumption. At the forefront of this transformation is Malaysia, a nation leveraging its strategic vision to position itself as a leader in halal products and finance. For investors, this presents a unique opportunity to tap into a market that aligns profitability with purpose. This piece provides a detailed, data-driven analysis of the halal economy, exploring its global scope, Malaysia’s pivotal role, and the macroeconomic implications for stakeholders worldwide.

The halal economy is a multifaceted sector encompassing food and beverages, pharmaceuticals, cosmetics, tourism, and finance. Its projected growth to $7.7 trillion by 2025 reflects a compound annual growth rate (CAGR) of 7.8%, driven by two key dynamics:

- Demographic Expansion: The global Muslim population, currently at 1.8 billion, is expected to reach 3 billion by 2060, according to Pew Research Center, amplifying demand for halal-compliant goods and services.

- Ethical Consumerism: Beyond Muslim consumers, non-Muslim markets in regions like the United States, Europe, and Asia increasingly favour halal products for their perceived quality, safety, and sustainability.

Halal Food and Beverages: Valued at $1.9 trillion in 2021, this segment is forecast to reach $2.8 trillion by 2025 (CAGR: 7.5%), fueled by demand for certified meat, processed foods, and beverages.

Islamic Finance: With assets at $3.8 trillion in 2021, this sector is projected to grow to $5.96 trillion by 2026, driven by sukuk (Islamic bonds) and Sharia-compliant banking.

Emerging Markets: Halal pharmaceuticals ($135 billion in 2021) and cosmetics ($80 billion) are expanding as consumers prioritise ethical sourcing, while modest fashion and halal tourism gain traction.

Technological advancements, such as blockchain for supply chain transparency and AI-driven certification processes, enhance compliance and trust, further accelerating market penetration. The convergence of these trends positions the halal economy as a structural force in global trade, appealing to both ethical investors and profit-driven stakeholders.

Malaysia has established itself as a cornerstone of the halal economy, supported by a robust regulatory framework under the Department of Islamic Development Malaysia (JAKIM) and the ambitious Halal Industry Master Plan 2030 (HIMP 2030). The sector is a vital economic contributor.

Export Growth: Halal exports hit $12.7 billion in 2023, with projections of $15 billion by 2025, reflecting Malaysia’s dominance in food, pharmaceuticals, and cosmetics.

Economic Impact: By 2025, the halal economy is expected to contribute 8.1% to Malaysia’s GDP, translating to approximately $37-41 billion based on a forecasted GDP of $463 billion.

Malaysia’s leadership is reinforced by:

Infrastructure: Halal parks, such as Halmas, have attracted RM16.75 billion ($3.9 billion) in cumulative investments by 2024, fostering production and innovation.

Certification Standards: JAKIM’s globally recognised halal certification facilitates exports to over 60 countries.

Global Ranking: Malaysia has topped the Global Islamic Economy Indicator for a decade, reflecting its competitive edge.

Trade agreements with ASEAN, the Middle East, and beyond amplify Malaysia’s ability to capture market share, making it a linchpin in the global halal supply chain.

Investing in Halal Finance: Sukuk and More.

The financial arm of the halal economy, particularly Islamic finance, is a cornerstone of Malaysia’s strategy. With assets totaling $620 billion in 2021 (18% of the global total), Malaysia dominates the sukuk market, issuing instruments tied to tangible assets rather than interest-based debt.

Market Trends: S&P Global Ratings predicts sukuk issuance will reach $190-200 billion by 2025, supported by liquidity improvements and monetary easing.

Investor Appeal: Sukuk offer stable returns (e.g., average yields of 3-5% for investment-grade issuances), serving as a hedge against volatility in conventional markets.

Beyond sukuk, Malaysia’s Islamic banking sector and innovations like green sukuk (for sustainable projects) align with global ESG (environmental, social, governance) priorities, broadening their appeal to institutional investors.

The halal industry’s trajectory is robust:

Global Outlook: By 2030, the halal economy could reach $10 trillion (CAGR: 5.5% from 2025), driven by population growth and market diversification.

Malaysia’s Ambition: HIMP 2030 targets a halal industry value of $113.2 billion by 2030, elevating its GDP contribution to 8.1% by 2025.

Technology: AI and blockchain streamline certification and supply chain integrity, reducing costs and enhancing scalability.

Emerging Markets: Indonesia, India, and Africa represent untapped potential, with rising Muslim populations and disposable incomes.

Policy Support: Malaysia’s investments in R&D and halal hubs signal long-term commitment.

This growth trajectory underscores the halal economy’s resilience amid global economic shifts, from inflation to supply chain disruptions.

Malaysia’s halal industry offers a spectrum of opportunities:

Food and Beverages: Representing 80% of halal exports, this sector benefits from halal parks and certification, attracting multinationals like Nestlé and Cargill.

Pharmaceuticals and Cosmetics: Rising demand for halal-certified drugs and beauty products drives R&D investment, with exports projected to grow 15% annually through 2027.

Halal Finance: Sukuk and Islamic funds provide stable, ethical returns, with government-backed incentives like tax breaks for SRI sukuk.

Support from the Halal Development Corporation (HDC) and Malaysian Investment Development Authority (MIDA), combined with a skilled workforce and raw material access, positions Malaysia as a strategic entry point for global investors.

Despite its promise, the halal economy faces hurdles:

Regulatory Fragmentation: Variations in halal standards across countries (e.g., GCC vs. ASEAN) complicate compliance for multinational firms. Malaysia’s efforts to harmonise standards mitigate this, but progress is gradual.

Supply Chain Risks: Ensuring end-to-end halal integrity is resource-intensive; disruptions or contamination could erode trust and market access.

Geopolitical and Economic Volatility: Instability in key markets (e.g., Middle East) or global downturns could dampen demand and investment flows.

READ e-copy: Kaaba News Magazine OCTOBER 2025 COMPLETE

Investors must weigh these risks against opportunities, employing due diligence and diversification to navigate uncertainties.

The halal economy’s future hinges on several possibilities:

Scenario 1: Accelerated Expansion: If ethical consumption trends intensify and technology adoption accelerates, the halal economy could surpass $12 trillion by 2030.

Scenario 2: Regulatory Alignment: Harmonised global standards could boost trade efficiency, potentially doubling halal export growth rates by 2030.

Scenario 3: Sectoral Shifts: Saturation in mature markets like halal food may shift focus to high-growth areas like pharmaceuticals and finance, requiring innovation to sustain momentum.

Malaysia’s proactive policies—e.g., HIMP 2030 and investments in halal tech—position it to thrive across these scenarios, particularly in emerging segments.

The halal industry, projected to hit $7 trillion by 2025, is a compelling growth story, blending economic potential with ethical resonance. Malaysia’s leadership in certification, finance, and innovation makes it a gateway to this dynamic market. This analysis highlights the interplay of demographic trends, technological advancements, and strategic opportunities, offering investors a roadmap to engage with one of the world’s most promising sectors. Whether through sukuk, halal exports, or emerging industries, the halal economy stands as a testament to the power of purpose-driven markets.

Fellow Nigerians! Know that, world non-Muslim countries supports Halal Economy Strategy:

Several non-Muslim majority countries have supported or are actively involved in the halal economy strategy, driven by global demand and the economic potential of the halal market. Major players include Brazil, the United States, China, and India, which are top exporters of halal products. Other countries like Japan, Australia, New Zealand, and Russia are also capitalising on the market by developing their own halal industries, focusing on export opportunities, tourism, and meeting both domestic and international demand for halal-certified goods.

Here are the countries with significant halal economy involvement:

- Brazil: A leading exporter of halal products, primarily meat and poultry, to Muslim-majority countries.

- United States: A major player in the global halal market, producing a significant portion of halal goods, including meat and poultry.

- China: A leading producer of halal goods with a large and expanding domestic market, in addition to its export efforts.

- India: A major exporter of halal products, particularly meat, to Muslim countries.

- Australia and New Zealand: These countries have established themselves as market leaders in the export of halal meat and poultry.

- Japan: Has strategically chosen to develop its halal industry, driven by globalisation and the desire to tap into the Muslim consumer market through sectors like halal food, tourism, and fashion.

- Russia: Has a growing halal market, with both Muslim and non-Muslim consumers purchasing halal food due to perceived quality and safety standards.

- Thailand: Has emerged as a significant halal food producer in Southeast Asia despite having a smaller Muslim population.

- United Kingdom: Has also been noted for its development of the halal tourism sector.

The world’s countries invests in Halal Economy Strategy:

Major countries supporting the Halal Economy Strategy include Malaysia, Indonesia, the UAE, Saudi Arabia, and Brunei, which are leaders in development and investment. Other countries like Nigeria, the Philippines, and even non-Muslim majority nations such as Australia and Thailand are actively developing their halal sectors to capitalise on global demand for quality, ethically produced goods and services.

Muslim-majority countries:

- Malaysia: A consistent leader in the Global Islamic Economy Indicator, focusing on halal food, finance, and tourism with strong government support through agencies like the Halal Industry Development Corporation (HDC).

- Indonesia: Actively encourages its small and medium-sized enterprises to target the global halal market.

- United Arab Emirates (UAE): A major hub for halal investments.

- Saudi Arabia: A key partner for countries like Nigeria in expanding the halal economy through agreements and strategic partnerships.

- Brunei Darussalam: Collaborates with other nations to create supply chains linked to the global Muslim market.

- Philippines: Plans to develop special economic zones for halal producers in its southern regions, particularly in Mindanao.

- Nigeria: Aims to boost its halal exports and has signed agreements with countries like Saudi Arabia to grow its GDP through the halal sector.

Non-Muslim majority countries:

- Australia: Has established a dual government- and Islamic-certified system to build trust in its halal exports, creating a strong global brand for its products.

- Thailand: Has also successfully capitalised on the halal sector.

My beloved people! Nigeria’s recent partnership with Saudi Arabia’s Halal Products Development Company (HPDC) is a bold move toward unlocking the potential of the global halal economy, valued at $7.7 trillion. Signed at the Makkah Halal Forum, the agreement aims to strengthen collaboration in halal food production, pharmaceuticals, Islamic finance, and livestock positioning Nigeria as a key player in this rapidly growing sector.

In Africa, Nigeria is the second-largest halal economy after Egypt. Both Egypt and Nigeria are also among the top 10 halal economies globally. Nigeria’s Muslim consumer spending is over two times that of Algeria, which has the third-largest Muslim consumer spending in the region.

- Muslim consumer spending on Halal products reached $2.1 trillion in 2022.

- Projected to hit $3.5 trillion by 2028.

- Food sector leads with $1.3 trillion in spending.

- Islamic finance assets valued at $3.6 trillion.

The Halal economy presents vast opportunities for businesses worldwide. Now, are you tapping into this rapidly expanding market or not?

The Halal Economy is currently valued at £7 TRILLION with rapid growth expected over the next year, In Shaa Allah. This figure just proves that Muslims are intelligent business owners and there is a significant demand for Halal products.

Here are the Differences between Muslim Economy and Halal Economy:

As the global Islamic economy grows, many people use “Muslim economy” and “Halal economy” interchangeably. But they’re not the same — and the difference matters, especially if you’re building products or platforms for Muslim markets.

Here’s a simple breakdown:

- The Muslim Economy: Refers to economic activity in Muslim-majority countries or communities. It’s shaped by demographics, culture, and local practices — but not everything in it is necessarily halal.

For example, you’ll find conventional banks, tourism services, or food offerings that may not follow Islamic guidelines.

- The Halal Economy: Is value-driven and Shari’ah-compliant. It includes products and services that meet Islamic ethical standards — such as halal food, Islamic finance, modest fashion, halal travel, or ethical tech.

And it’s not limited to Muslim countries and open to anyone who values ethical, transparent, and responsible consumption.

- Examples of the Muslim Economy:

– Indonesia’s tourism industry (a mix of halal and non-halal options).

– Senegal’s banking sector (conventional + Islamic banks).

– Malaysia’s food market (not all products are halal-certified).

- Examples of the Halal Economy:

– Islamic finance (sukuk, takaful).

– Certified halal food & beverages.

– Modest fashion brands guided by Islamic principles.

– Ethical tech platforms with Shari’ah values.

The Global Opportunity:

The Halal economy is going global — opening doors for businesses, investors, and professionals who want to align with ethical and faith-based standards, regardless of background or religion.

In short:

- Just because it’s by Muslims doesn’t mean it’s Halal.

- Just because it’s Halal doesn’t mean it’s only for Muslims.

Or more precisely:

- It’s not Halal because it’s from Muslims.

- It’s not non-Halal because it’s from non-Muslims.

Now, dear brothers and sisters! Are you building or investing in this space? Please let’s connect and shape the future of the Halal economy together!

All praise is due to Allah, the Lord of the worlds. Prayers, peace and mercy are upon our beloved master, Muhammad, the son of Abdullah (Peace be upon him), his family and Companions.

Murtadha Muhammad Gusau is the Chief Imam of Nagazi-Uvete Jumu’ah and the late Alhaji Abdur-Rahman Okene’s Mosques, Okene, Kogi State, Nigeria. He can be reached via: gusauimam@gmail.com or +2348038289761 or +2348024192217.